The world could soon see its first trillionaire. But how to measure the net worth

of the ultra-rich?

Experts have their ways of grasping the wealth of the 1% in more concrete terms — even if their measurements are merely snapshots in time.

A recent Oxfam International report found that the world’s ultra-rich are getting vastly richer — so much so that the first trillionaire is due within a decade.

The five richest men in the world — billionaires Elon Musk, Bernard Arnault, Jeff Bezos, Larry Ellison and Warren Buffett — saw their enormous fortunes double since the onset of the COVID-19 pandemic in 2020, according to Oxfam International.

“At current rates, it will take 230 years to end poverty, but we could have our first trillionaire in 10 years,” states the report, which highlights the growing inequality alongside the staggering net worth of the five men.

If the sheer magnitude of the top five’s wealth already seemed unfathomable in the hundreds of billions, a potential trillion-dollar portfolio might seem beyond the pale. But experts have their ways of grasping the wealth of the 1% in more concrete terms — even if their measurements are merely snapshots in time, says John Bai, an associate professor of finance at Northeastern.

Ownership stakes in companies

Because the top five obtained the vast majority of their wealth through owning businesses, the key is to look at the market value of those companies, and their ownership stakes, Bai says.

“They own a certain percentage of their firm, and when a magazine like Forbes or any other website tries to compute their wealth, they will simply multiply that percentage by the firm’s estimated market value on a specified day,” Bai says.

Bai notes that because of stock price volatility, net worth calculations “must be interpreted with a clear timestamp on them.”

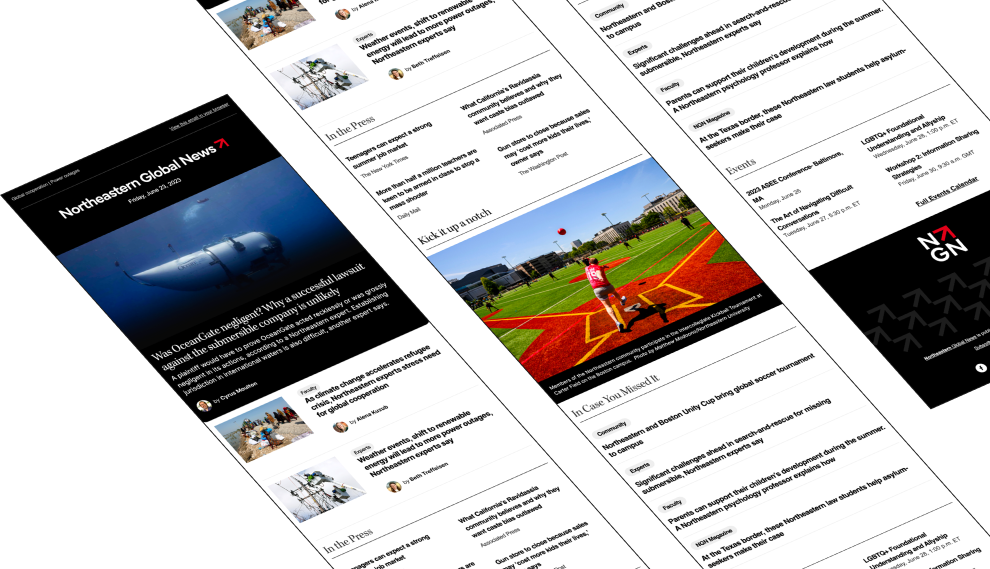

Featured Posts

Assets minus liabilities

Measuring a person’s net worth isn’t a measure of income, which, in financial terms, is part of their cash flow. Rather, it’s a ballparked value of their assets minus liabilities, says Alvaro Cuervo-Cazurra, professor of international business strategy at Northeastern.

The billionaires identified by Forbes “have not ‘earned’ the money in the sense of income, which is the money one gains over a period of time, usually a year, such as a salary,” Cuervo-Cazurra says. “Wealth is a measure of the value assets they own, typically a share of large firms whose value increases over the year.”

The value of a firm is a measure of the “expected value” that the company will generate in the future, he says.

Impact of market volatility

Of course, this figure is often difficult to discern because of market volatility. The value of tech stocks, for example, can swing wildly in response to the smallest industry ripple, in addition to broader social, economic and political developments. When Meta, formerly Facebook, recently announced that it plans to buy 350,000 Nvidia H100 graphics processing units, its stock value swung several billion dollars that same day, Bai says.

“Their companies are especially volatile in terms of stock prices,” Bai says. “We don’t see the CEOs or founders of manufacturing companies, for example, become trillionaires. There’s no hope. The Big Four [Musk, Bezos, Bill Gates, Mark Zuckerberg] are almost universally tied to either web-based or tech platforms or AI-related ventures. It’s both the inherent nature of their business, but also regulatory certainty and the pace of innovation activity.”

Will it be Musk?

On the race to become the first trillionaire, Bai says he thinks Musk could come out ahead if Tesla’s self-driving vehicle technology powered by artificial intelligence proves to be successful. Indeed, the company’s stock market valuation turns in part on its investors’ belief that Musk will lead the industry toward a driverless future.

For each man in the top five, net worth calculations vary based on publicly available data (private equity ownership, Bai says, is inaccessible). So, too, does their liquidity — the ability of any one of them to convert their assets into cash.

The majority of Musk’s wealth is a product of Tesla stock, which is easily computable, Bai says.

“So for Musk, who is relatively very concentrated in his wealth and overall investments, it’s easier” to gauge his net worth, he says. “But compared to someone like Bill Gates, who owns less than 1.5% of Microsoft at this point in time. The majority of Gates’ holdings are diversified away.”

Wealth and philanthropy

Patricia Illingworth, a professor of philosophy and business at Northeastern University and author of “Giving Now: Accelerating Human Rights for All,” notes that “there are lots of tax loopholes and no doubt many billionaires take advantage of them, as do many other people and many corporations.”

Illingworth also pointed to the disparities in how the mega-rich give back. Additionally, she argues that how their money is spent matters.

“It is not possible to treat the philanthropy of all donors and billionaires as if they were the same,” Illingworth says. “The Gates Foundation, for example, has given an enormous amount of money to global health, more than most countries.”

Bai notes that the arrival of the world’s first trillionaire only further underscores the need to address growing inequality.

“If you think about it, we want to grow the pie first, and then split it more evenly,” Bai says. “The emergence of a trillionaire already tells us that we’ve grown the pie big enough. It’s now time to think about how to divide the pie a little more equitably, or risk more social instability.”